TRX Price Prediction: Technical Strength Meets Cautious Optimism Amid Market Volatility

#TRX

- Technical Momentum Building - MACD bullish divergence and Bollinger Band positioning suggest potential upward movement if key resistance levels are breached

- Ecosystem Expansion Support - USDD's Ethereum integration and 12% APY incentives provide fundamental growth drivers for TRX's utility and adoption

- Market Sentiment Crosscurrents - While stablecoin growth and institutional demand remain strong, security concerns from recent attacks create near-term headwinds that require cautious positioning

TRX Price Prediction

TRX Technical Analysis

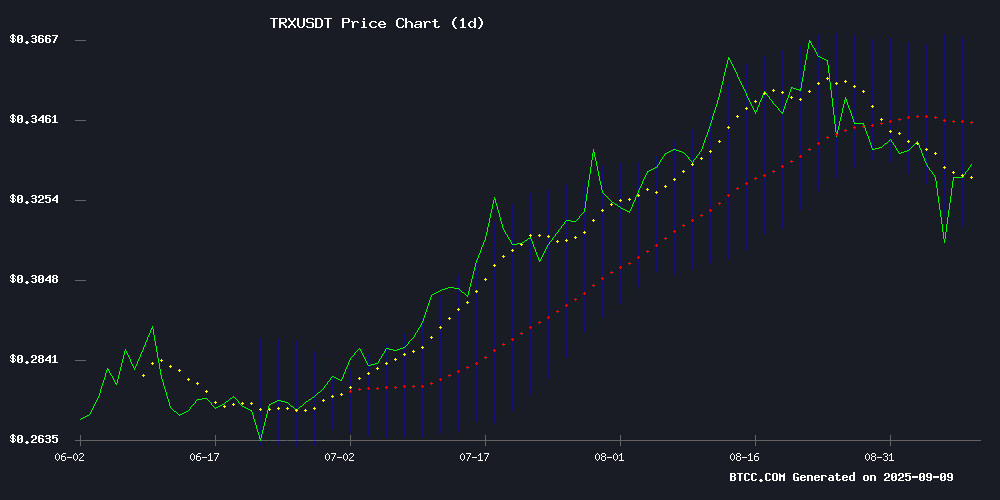

TRX is currently trading at $0.3348, slightly below its 20-day moving average of $0.342005, indicating potential short-term consolidation. The MACD reading of 0.014538 above the signal line at 0.010119 suggests bullish momentum is building, though the positive divergence of 0.004419 remains modest. Bollinger Bands show price action NEAR the middle band with upper resistance at $0.366191 and lower support at $0.317819, creating a relatively stable trading range.

According to BTCC financial analyst William, 'The technical setup suggests TRX is testing key support levels while maintaining overall bullish structure. A break above the 20-day MA could trigger upward momentum toward the upper Bollinger Band.'

Market Sentiment Analysis

Current crypto market sentiment is mixed despite positive developments in the stablecoin sector. Ethereum's record $165 billion stablecoin supply and institutional demand growth provide underlying strength to the ecosystem. However, the largest supply chain attack in history targeting crypto users through compromised JavaScript packages has created near-term headwinds for broader adoption.

BTCC financial analyst William notes, 'USDD's expansion to ethereum with 12% APY incentives demonstrates growing DeFi competition, but security concerns from the recent attack may temporarily overshadow positive fundamental developments. TRX benefits from ecosystem growth while facing broader market caution.'

Factors Influencing TRX's Price

Largest Supply Chain Attack in History Targets Crypto Users Through Compromised JavaScript Packages

A sophisticated cyberattack has emerged as the largest supply chain breach in history, specifically targeting cryptocurrency users through compromised JavaScript packages. Security researchers identified a malicious campaign injecting wallet-draining malware into 18 widely-used NPM libraries, including fundamental tools like 'chalk', 'debug', and 'ansi-styles' with collective weekly downloads exceeding 2.6 billion.

The attackers employed a phishing scheme, impersonating NPM registry support to hijack maintainer accounts. The malware operates as a browser-based interceptor, actively monitoring and altering cryptocurrency transactions across major networks including Ethereum, Bitcoin, Solana, Tron, Litecoin, and Bitcoin Cash. During transfers, it silently substitutes destination wallet addresses with attacker-controlled accounts.

This unprecedented attack vector exposes critical vulnerabilities in the JavaScript ecosystem's dependency chain, particularly threatening decentralized finance platforms and browser-based wallet solutions. The incident underscores growing security challenges as crypto adoption expands into mainstream development environments.

Ethereum Stablecoin Supply Hits Record $165B Amid Institutional Demand

Ethereum's dominance in the stablecoin market has reached new heights, with its total supply surging to $165 billion—a figure that has doubled since January 2024. Institutional and retail investors are flocking to the network, adding roughly $1 billion in stablecoins daily last week. Token Terminal data confirms Ethereum commands 57% of the stablecoin market, far outpacing Tron's 27% and Solana's 4%.

The network is also emerging as the preferred platform for tokenized commodities. Ethereum now hosts $2.4 billion in tokenized gold, representing 77% of the market. When including layer-2 solutions like Polygon, this share jumps to 97%. The growth underscores Ethereum's evolving role as a bridge between traditional finance and decentralized ecosystems.

USDD Expands to Ethereum in Strategic Move for DeFi Dominance

USDD, the decentralized stablecoin backed by Justin Sun, has launched natively on Ethereum, marking its largest chain expansion beyond TRON. The deployment includes a Peg Stability Module (PSM), enabling direct on-chain minting and swaps with USDT and USDC. This move aims to embed USDD deeper into Ethereum's liquidity layer, bypassing simple cross-chain bridging.

The expansion targets Ethereum's status as the largest Layer 1 ecosystem, home to the deepest concentration of DeFi developers, protocols, and capital. An airdrop campaign with tiered yields is set to begin on September 9, further incentivizing adoption.

By anchoring itself to Ethereum, USDD positions for broader institutional and retail integration, leveraging the network's unrivaled liquidity and infrastructure. The CertiK-audited deployment signals a calculated push into DeFi's heartland.

USDD Launches on Ethereum with Airdrops and 12% APY Incentives

USDD, the decentralized stablecoin pegged to the US dollar, has officially launched natively on Ethereum. Tron founder Justin Sun heralded the move as a pivotal moment for decentralized finance, offering users an alternative to centralized stablecoins.

The deployment includes a Peg Stability Module (PSM), enabling seamless swaps between USDD, USDT, and USDC. Audited by CertiK, the expansion marks USDD's evolution into a multi-chain asset. An exclusive airdrop campaign and yield opportunities up to 12% APY aim to drive adoption.

Ethereum Dominates Stablecoin Market with $165 Billion Milestone

Ethereum has cemented its leadership in the stablecoin sector, surpassing $165 billion in total supply—a 57% market share dominance. The network added $5 billion in stablecoins last week alone, averaging $1 billion daily inflows.

While Tron trails at 27% and Solana holds under 4%, Ethereum's infrastructure for tokenized assets like gold and Treasuries has fueled a 200% price surge since April 2024. This growth underscores ETH's pivot from smart contract platform to the backbone of institutional-grade stablecoin activity.

Is TRX a good investment?

TRX presents a cautiously optimistic investment case based on current technical and fundamental factors. The token trades slightly below its 20-day moving average but shows bullish MACD momentum, suggesting potential for near-term recovery. However, investors should consider both the opportunities and risks:

| Factor | Assessment | Impact |

|---|---|---|

| Technical Position | Below 20-day MA but bullish MACD | Neutral to Positive |

| Bollinger Band Position | Middle range trading | Neutral |

| Ecosystem Growth | USDD expansion, Ethereum integration | Positive |

| Market Sentiment | Security concerns offsetting fundamentals | Negative |

| Stablecoin Trends | Record $165B institutional demand | Positive |

As BTCC analyst William suggests, 'TRX shows technical resilience amid market uncertainty, but investors should monitor the $0.317 support level and consider dollar-cost averaging given current volatility.'